This pandemic is a totally scary, unprecedented time in all aspects of our lives, including finances. Businesses are closing their doors, employees are getting furloughed or laid off, the stock market is plunging (or so I am told by my dad)—if we weren’t worried about our finances before, we certainly are now. During this heightened time of stress, many are struggling to figure out what they can do to ensure financial security. Our advice? Don’t check your 401(k) for a while… it’s only going to make you freak out even more. And to help put your mind at ease and give you tips on actions you can take to protect yourself, we spoke to Ken Lin, CEO of Credit Karma, about what you should be doing, and the types of mistakes to avoid.

1. Know Your Options

The situation we’re in is a weird one that no one saw coming (well, except the world leaders who were warned about it and tried to ignore the problem, thinking it would go away, but that’s neither here nor there). An important thing to keep in mind is that banks realize we’re in a f*cked up situation right now and may offer you a new plan in response to what’s happening. Lin advises to take matters into your own hands and “call your credit card issuer, as they may offer a hardship plan, which sometimes offer lower interest rates, smaller minimum payments and/or lower penalties.” I’m sure the last thing you want to do now is get on the phone and wait on hold, but you have the time, and it could help you a lot, so just do it.

2. Pay The Minimum Amount Due If You Can

If you aren’t getting paid your usual salary, your hours have been cut, or you’ve been laid off or furloughed, you may be freaking out about paying your credit card bill in the next few months. While it’s usually best to pay in full each month, Lin says, “during times of stretched income, try and pay just the minimum payment to help you avoid late fees or dings to your credit.” The good news is that issuers typically won’t report the late payment until it’s 30 days past due, so you may have a bit of wiggle room. Lin explains, “If you can make your payment before the 30-day mark, you may not have to worry about the late payment being added to your report.” So if you can afford to make that minimum payment, even if it’s a couple of days late, it can save you stress and may not incur late fees, but just make sure you double-check your credit card details.

3. Don’t Default To Swiping Your Credit Card

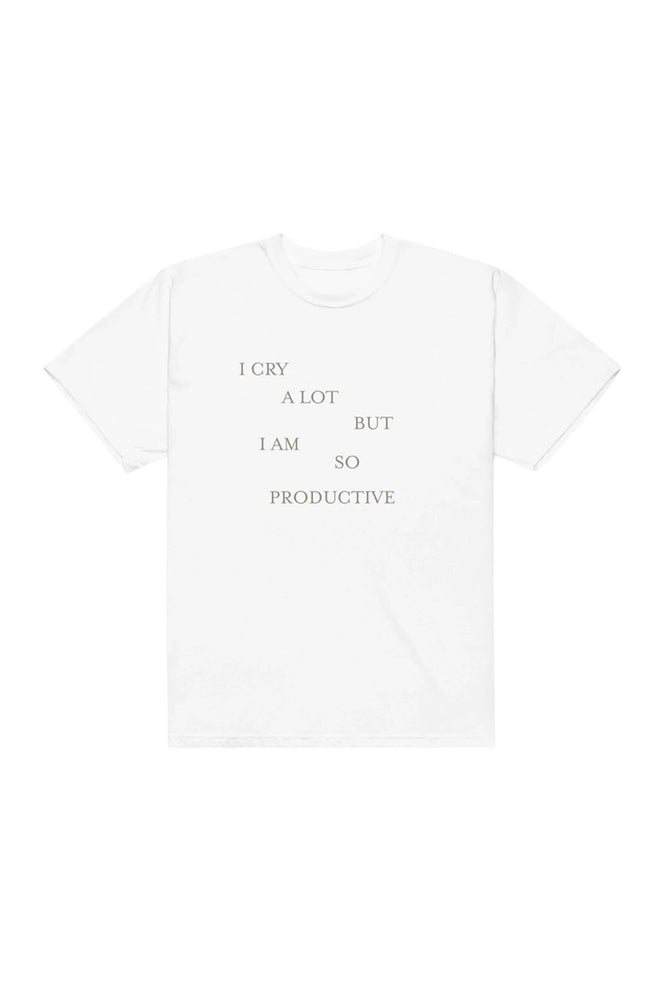

I don’t know who needs to hear this but STOP online shopping during quarantine… oh wait that’s me

— Linsey Meister (@linseyx5) March 25, 2020

You may want to make purchases on your credit card in order to make ends meet, but there might be better options out there. Lin advises, “If you’re looking for an alternative, often times personal loans will have lower interest rates than credit cards.” He also offers that before you swipe or open up an additional line of credit, you take note of the interest rate on your credit card and make sure you’re not accruing additional interest and fees.

4. Think Twice Before Taking Out A Payday Loan

Before you borrow any money, take a nice hard look at the fine print. Lin cautions, “Payday lenders tend to prey on those in desperate circumstances like these, and these loans can be the beginning of a long cycle of debt.” He advises holding off on these types of loans, as “a payday loan may carry unfavorable terms, including high fees and interest rates.” The best thing to do, he says, would be to look into other options available to you, such as emergency or personal loans.

We’re all feeling all kinds of emotions right now, but it’s important you take care of yourself, and part of taking care of yourself is making sure your finances are in check. Trust me, everyone is in the same boat. When in doubt, look into your options and talk to someone on the phone. There may be solutions there you haven’t thought were possible.

Images: Sharon McCutcheon / Unsplash; @linseyx5/Twitter